apps like quadpay for bad credit

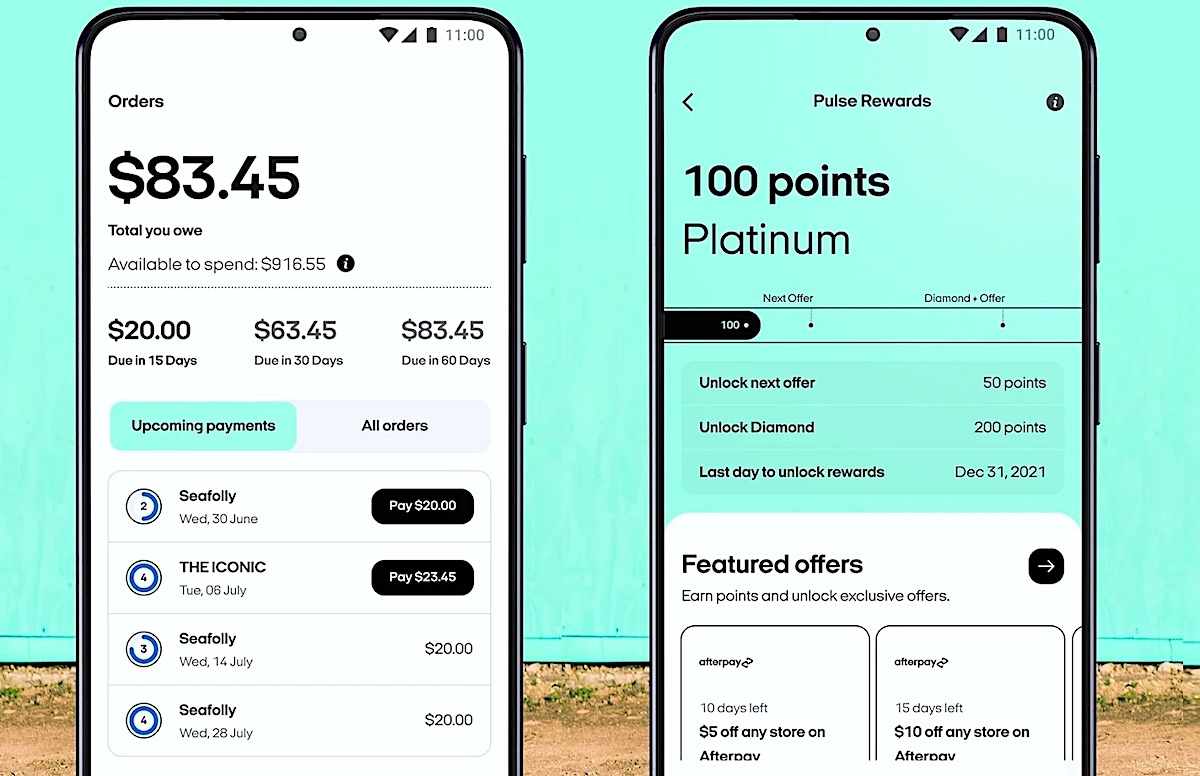

They problem is especially for those with bad credit and a lack of financial savvy membership exposes you to a variety of predatory practice designed to get you to pay additional fees. Apps like Afterpay are more likely to charge no interest.

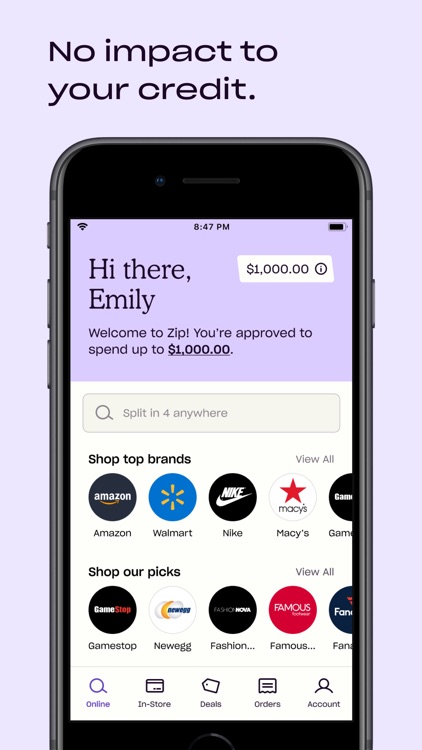

Zip Previously Quadpay By Zip Co Us Inc

Started in 2009 Zest Finance is one of the really good financial tech companies like Affirm.

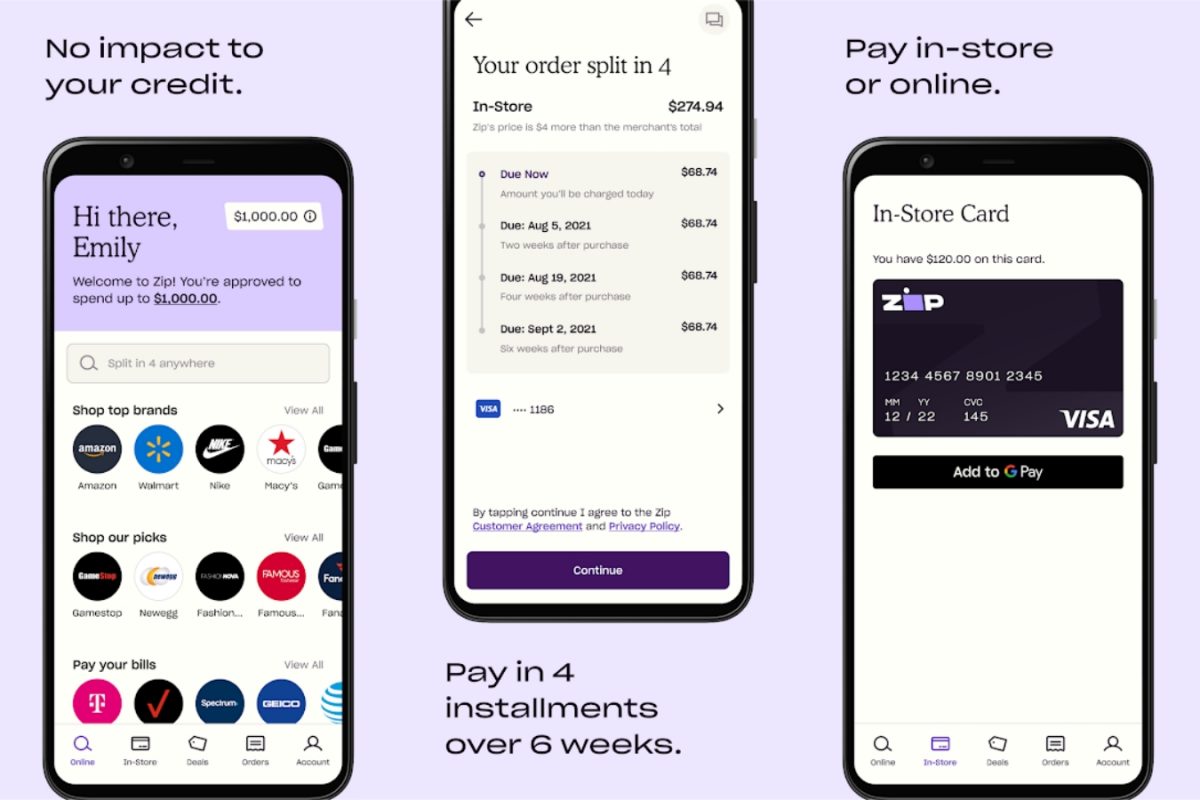

. About Zip Previously Quadpay Information written by the company. No effect to credit score. No hard credit pull to qualify for installment plans or pay later.

No interest or fee for plans. Credit checks will be undertaken and a rejection or approval will be given immediately. Applying wont impact your credit score.

Safe Secure Fast Form. Late fees start at 7 and are capped at 14. Zest Finance is heavily into Model Data.

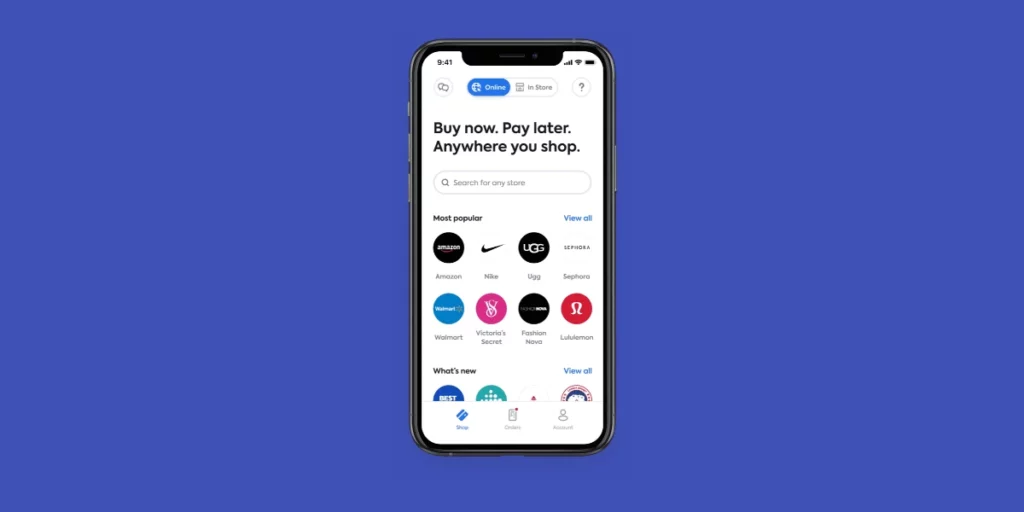

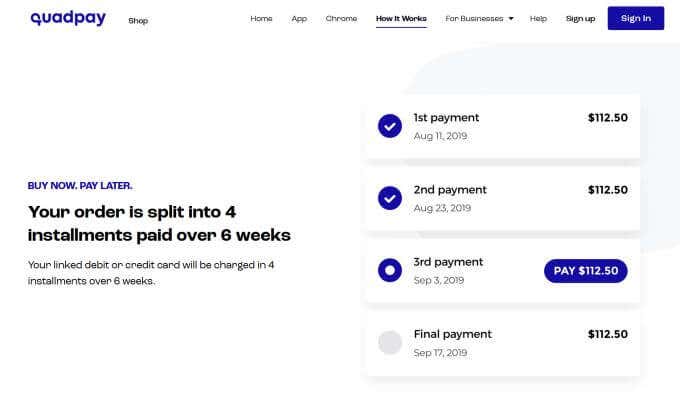

Customers can split any purchase in 4 installments over 6 weeks interest-free. These 5 apps and websites listed below will allow you to book your travel now for free or very little payment upfront. Quick Online From - Simple 3 Minute Form - Get Started Now - Connect with a Lender.

The service may help you cover important purchases but it comes with several downsides. Because its sole purpose is to let you pay for purchases in four installments you must use QuadPay Visa Card through the QuadPay app. If your APR exceeds 20 a credit card may be cheaper.

Were entirely differentfree of fees applications and credit checks. Credit limits will depend on each individual with increases available as time goes on. Understand the fine print before using installment plans like Afterpay Quadpay Klarna and Paypals Pay in 4.

Buy now pay later in four - 9 Similar Apps 4 Review Highlights 353587 Reviews. Zip formerly known as Quadpay is a buy now pay later form of financing that allows you to make a purchase and split your payment into four equal interest-free installments. Afterpay is a buy now pay later bad credit option.

A completely new way to pay. You can be approved for a limit of 1000. 4 equal installments over 6 weeks.

Split any purchase into 4 installments. Zip previously Quadpay gives savvy shoppers more freedom and flexibility to pay later anywhere with our buy now pay later platform. Theres a maximum spending credit limit of 3501000.

You can request an increase of up to 1500 six months after your first purchase. Apps like Afterpay tend to have smaller late fees. Shoppers can choose their own plans with long-term plans like 6 12 18-.

This is one of the best ways to improve your credit rating and cut down on the losses in a smart-way. Just keep in mind the six weeks they typically give you to pay off your purchase isnt much longer than the grace period many credit cards offer. It offers instant approval and spreads four installments over six weeks and it doesnt charge interest or fees.

Pay later service is aimed at people with bad credit. No interest or fee for plans. Financing plan applications trigger a credit check.

Here are some of the best companies that provide financial tech like Affirm does-. Bills Rent Household Expenses or any other Urgent Matters. Log in as a merchant instead.

It also doesnt check your credit report so theres no minimum credit score requirement. Additionally if you apply for a line of credit through a merchant you might be approved for more than 5000. You cant borrow more than the purchase amount.

You can use the QuadPay Visa Card to pay for purchases at any online retailer that accepts Visa and any. We arent like other buy now pay later options. POS financing can lead to overspending.

Ad All Credit Types OK. Missing payments can hurt your credit score. BNPL apps approve borrowers with bad credit.

Enter your phone number to receive a one-time code to login. Ad Loans for Essential Needs. - They do not let you make automatically scheduled payments.

Ad Compare Best No Credit Loans 2022. Enter your email address to receive a one-time code to login. Late payments are subject to a 10 fee.

The QuadPay Visa Card is a virtual card a product that exists digitally instead of as a physical card. Applying for a personal loan may result in better terms. Positive Negative Reviews.

4 equal installments over 6 weeks. Get Your Loan In 24 Hours. Zero interest no hard credit check.

You make your purchases. So youre not buying yourself a whole lot of time. Paired with regular credit increases its an attractive looking option for this with bad credit.

For the responsible credit card user who pays diligently and doesnt want a new loan under their name Splitit is the smarter more sensible choice. Its good for people who have bad credit because it doesnt check your credit history and it uses your verified income to set your spending limits. If you are looking to improve your credit score then Perpay could be the BNPL app for you.

11 Best Apps Like Quadpay For Android Ios Apps Like These Best Apps For Android Ios And Windows Pc

11 Best Buy Now Pay Later Apps To Use Right Now In 2022

13 Best Apps Like Quadpay Now Zip To Try In 2022 Rankred

Top 10 Buy Now Pay Later Apps 2022 Guide Shop Safely

15 Best Apps Like Klarna 2022 Rigorous Themes

Shopportunist A Buy Now Pay Later Primer

Affirm This Bnpl Stock Has Good Growth Potential Nasdaq Afrm Seeking Alpha

Afterpay Vs Quadpay Vs Klarna Vs Sezzle Grand Comparison Viraltalky

Quadpay Not Working Fix 2022 Viraltalky

The Best Buy Now Pay Later Apps Ecommerce Platforms

13 Best Apps Like Quadpay Now Zip To Try In 2022 Rankred

11 Best Buy Now Pay Later Apps To Use Right Now In 2022

5 Best Afterpay Alternatives To Shop Now And Pay Later

13 Best Buy Now Pay Later Apps For Easy Shopping

13 Best Apps Like Quadpay Now Zip To Try In 2022 Rankred